Nutrition taxes: a broken tool in public health policy

Economic Note

Read the Economic Note in PDF format… | Read the Media release…

Economic Note prepared by Frédéric Sautet, associate researcher at the Institut économique Molinari

Excess weight and obesity have been on the rise for more than 40 years in many countries around the world. The United Nations has stated that obesity is now a greater threat than smoking. At present, 15% of French adults are considered obese — meaning they have a body mass index (BMI) over 30 — compared to only 8.5% in 1997.(1) In the United States, one-third of the population is regarded as overweight (with a BMI of 25 to 30), and an additional one-third is obese. These figures have doubled since 1980. Higher consumption of foods seen as being low in nutritional value (especially those containing saturated fats or fast sugars) takes the blame. In France, sugary drinks and, more recently, oils high in palmitic acid, have made headlines. The latter are used in the production of many foods (Nutella, for example) with nutritional properties that have been questioned by some experts.

Recent reports by French senators Yves Daudigny and Catherine Deroche(2) and by Professor Serge Hercberg(3) highlight the public health problems (cardiovascular disease, diabetes and cancer) linked to expanding waistlines. The Hercberg report also notes that, since France’s National Nutrition and Health Programme was launched in 2000, it has not halted rises in excess weight, diabetes or hypertension. The solutions suggested in both reports are based on three lines of analysis: a) the social cost of excess weight; b) irrational behaviour by consumers; and, to a lesser degree; c) social inequalities in health.

Instituting new taxes on foods targeted for lower consumption would be the main remedy.(4) Subsidies (financed by these levies) for healthful foods would provide new incentives to encourage their consumption.(5) Nevertheless, both reports note that poor nutrition and its consequences are a complex problem that calls for an entire set of solutions, though they mostly favour tax measures. These are not a panacea, however: their effects on changes in dietary habits are often uncertain, making it hard to pursue the stated goals.

THE GROWTH IN NUTRITION TAXES

Applying indirect contributions (excise duties or ad valorem taxes(6)) to certain items to control their consumption have a long history. The first taxes on alcohol for the purpose of enhancing public health date back to 17th-century England.(7) Today a growing number of governments seek to tax food products that may be harmful to health (in addition to alcohol and tobacco), although some of these taxes are still in the form of proposals.

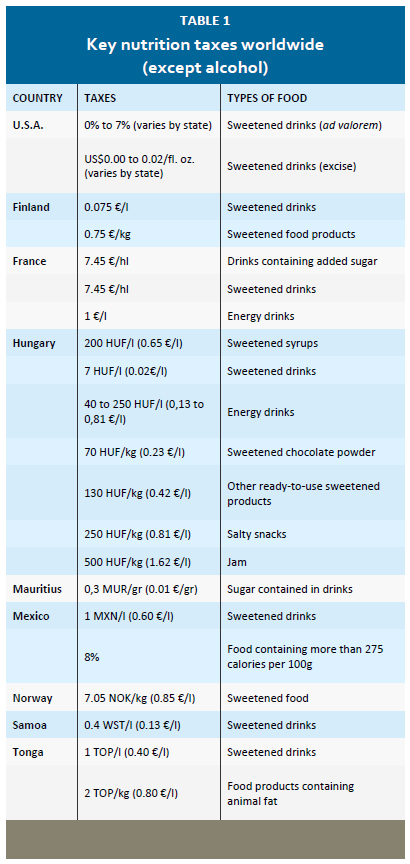

More than 39 U.S. states tax soft drinks, as do the cities of Chicago and Washington. California and Texas, for example, impose a 6.25% tax. In France, the government introduced levies in 2011 on drinks containing added sugars and sweeteners, amounting to €7.45 per hectolitre in 2014. In October 2013, the French parliament also voted for a tax of €1 per litre on energy drinks. Over all, there now exist nine levies in France that correspond to the concept of nutrition taxes.(8) Finland imposes a tax of €0.075 per litre on sugary drinks. It also taxes certain sweetened food products such as chocolate at a rate of €0.75 per kilogramme. Since 2012, Hungarians have been taxed on their consumption of salt, sugar and caffeine, with snack foods taxed at 250 forints (€0.80) per kilogramme. Mauritians have had to pay a tax on soft drink consumption since January 2013. Faced with a rising obesity rate, Mexico established a tax of one peso (€0.60) per litre on sugary drinks at the end of 2013, along with an 8% levy on foods containing more than 275 calories per 100 grams. Norway imposes a levy of 7.05 kroner (€0.85) per kilogramme on sweetened foods. And several South Pacific countries such as Fiji, Samoa and Tonga impose taxes or customs duties on sugar and soft drinks (see Table 1).

Other countries, such as Ireland, Italy and Malaysia, are planning to follow similar policies. In addition, these tax reforms have led developing countries such as the Philippines to introduce for the first time, in 2013, sweeping taxes on alcohol and tobacco consumption.(9) Even Singapore seeks to boost its tobacco and alcohol taxes.(10)

Other countries, such as Ireland, Italy and Malaysia, are planning to follow similar policies. In addition, these tax reforms have led developing countries such as the Philippines to introduce for the first time, in 2013, sweeping taxes on alcohol and tobacco consumption.(9) Even Singapore seeks to boost its tobacco and alcohol taxes.(10)

DO OBESE PEOPLE MAKE OTHERS SHARE THEIR BURDEN?

The traditional economic justification for regulating some forms of behaviour is based on the principle of “externalities”. This principle holds that there is no reason for government to be involved in individual choices unless actions by some people generate involuntary costs for others. It is argued that the consumption of items with poor nutritional properties may affect all of society, notably with respect to health care financed by the rest of the population. The numbers are high for obesity, accounting for a social cost of $147 billion in the United States in 2011.(11)

However, the calculation of externalities relies on assumptions that are open to criticism. The relevant time scale is not a year but an entire lifespan. Some studies indicate that long-term externalities for tobacco are nil if smokers’ early deaths are taken into account.(12) Preventing tobacco and alcohol consumption increases life expectancy but also raises costs related to other pathologies due to longer lifespans. Also, with a focus strictly on health care spending over a total lifespan, the benefits of preventing obesity may be called into doubt.(13) Obese people do generate extra health care costs but over a shorter lifespan, which may offset the extra spending.(14)

Finally, while externalities can exist, they may not be caused by market failure but rather by regulations that prohibit health insurance premiums from being linked to a person’s weight, thereby strongly reducing the incentives to cut consumption of nutritionally poor food and making taxpayers bear the higher medical costs that may result.(15)

IS IT IRRATIONAL TO EAT TOO MUCH NUTRITIONALLY POOR FOOD (AND TO HAVE A PAUNCH)?

Externalities may be related not only to the costs borne by others but also to the costs borne by oneself in the future (economists call this an “internality”). In some circumstances, individuals may not be sufficiently rational and government should prevent them from later regretting decisions made now.(16) But consuming saturated fats, sugars and alcohol is not necessarily the result of individual irrationality. Clearly, individuals may make mistakes, and their habits may reflect an existing addiction. However, it is worth analysing all the phenomena that may explain weight gain without assuming that individuals have little control over themselves. In particular, this consumption may reflect the increased value of time.

The growing prevalence of sedentary lifestyles, with the emergence of the service society and the increase in labour productivity, is a factor in weight gain. Everyday physical activity has fallen sharply. Rich countries saw a decline in arduous labour during the 20th century. This would tend to indicate that excess weight and obesity are related to technological progress that saves on physical activity.(17) It is therefore perfectly rational to benefit from a reduction in heavy labour even if this contributes to lowering everyday physical activity (including time spent in public transport). The emergence of fitness clubs since the 1970s is a market response to the decline of everyday physical activity. But exercising also has a cost in terms of time spent doing other things, limiting its effects.

Another phenomenon is the lower cost of food due to rises in productivity and purchasing power. In France, the share by value of food spending went from 30.6% of consumption budgets in 1959 to 15.4% in 2013.(18) In the United States, the corresponding figure was 9.8% in 2011. Also, Americans now go to restaurants more often: in 1966, families spent 31% of their food budgets there, compared to 46% today.(19) Meanwhile, the French are turning increasingly to prepared dishes as part of their meals (41% of food spending) and eat less fresh products.(20) These facts reflect the growth in the value of time. The lower price of food and greater consumption of prepared products have resulted in higher everyday calorie intake since the 1970s.(21)

Cheaper food and improved technology (including the development of many drugs that help fight diabetes and hypertension) have had unexpected effects on weight, due in particular to the greater value of time produced by growth in the resources available to us. Individuals have more choices, but there are still only 24 hours in a day. This makes it rational to try to save time (for example, by eating at a restaurant or using a car or train), leaving more time for the family or for leisure activities.

A DIFFERENT PERSPECTIVE ON “SOCIAL INEQUALITIES IN HEALTH”

Another argument in favour of nutrition taxes is based on the idea that there exist social inequalities in health, with the less wealthy classes lacking access to the most nutritious foods, something the state should correct.

This egalitarian argument disregards changes in real household income, in relative food prices and in the quantities consumed. In addition to the fact that the share of household budgets devoted to food has fallen by half since 1950 in France, the prices of basic items such as eggs, butter and salt have fallen in real terms in the last 100 years, enabling poor families to feed themselves better.(22) Consumption of bread, potatoes and dry vegetables (beans were once the “poor man’s meat”), and of starchy items in general, have fallen sharply since 1900 in France, reflecting growth in purchasing power that has favoured consumption of items that were once too expensive, such as sweetened foods, eggs, meat and fish.(23) Although the less wealthy social classes may not consume the most nutritious foods, they do consume more of the essential items that were previously beyond their reach.

Fast food is often denounced as a source of nutritionally poor food. But it has helped reduce the cost of protein intake, a factor that is far from negligible when there are several mouths to feed. It is also a response to the increased value of time, including that of low-income people.

NUTRITION TAXES: AN INEFFECTIVE POLICY

The biggest problem with nutrition taxes lies in estimating their impact. What is needed is a precise idea of individuals’ sensitivity to price variations (“price elasticity”). An initial problem arises from the impossibility of getting an accurate measure of this elasticity. As such, nutrition taxes may have effects that run counter to those initially sought by generating a strong response from those who consume nutritionally poor food in moderate quantities but without changing the habits of those who abuse it, because the latter are generally less sensitive to the price.(24) One possible result is a reduction in moderate alcohol consumption with no decline in alcoholism. The same goes for obesity. A rise in the price of some food products could lead to greater culinary activity at the expense of physical activity and therefore to weight gain.(25) In addition, when consumption of sugary drinks accounts for only a small portion of everyday caloric intake, higher taxes would have a limited effect on the body mass index of an overweight person.(26)

The impact of taxes (incidence) is not always what lawmakers expect. This can be seen in the weak effect of higher tobacco taxes on selling prices.(27) Taxes do not affect consumers alone: they are also absorbed by producers who may see their margins decline, in particular under pressure from the alternatives available to consumers (substitution of other products, illegal imports, etc.).(28) Another undesirable effect from the standpoint of lawmakers is people fleeing a tax. When a “fat tax” was in place in Denmark, up to 48% of Danes went shopping in nearby countries.(29) This leakage may also contribute to higher consumption of the taxed goods if consumers buy in bulk in a neighbouring jurisdiction.(30) Moreover, excessive taxes may help develop a black market, as in Russia, where the quantity of vodka produced illegally rose sharply after an increase in alcohol taxes in 2013.(31)

Nutrition taxes are strongly limited by the reactions of consumers and producers. Consumers may replace taxed foods with untaxed (or lower taxed) items that may be just as poor in nutritional terms.(32) In France, fruit juices without added sugar are not taxed and could benefit over time from the tax on sugary drinks, with no overall reduction in the quantity of sugar ingested. Consumers could also switch from premium brands to house brands. The substitution effect would necessitate a broader tax solution, making the tax base even more complex. It also seems that poorer households bear a large part of the tax burden because, in proportion to their budgets, they consume more taxed items.

Finally, defining what constitutes a sweet drink or energy drink is not always simple. Some U.S. states tax frappuccinos (a drink sold at Starbucks cafés) while others leave them untaxed because they contain milk, caffeine and no carbonation.(33)

WHAT HAPPENS WHEN GOVERNMENT PUTS ITS NOSE ON OUR PLATES

Individual irrationality and lack of information are often used to justify a benevolent paternalism aimed at encouraging people to make the right choices. The imposition of labelling that provides better information is an obvious example of this.(34) However, government intrusion on our plates is hardly bereft of undesirable effects.

When government gets involved, solutions that emerge on the market and that may cost society far less in the long run are underestimated or disregarded. The rapid development of organic products and high-nutrition products in Europe and the United States marks a clear shift in the market. Production of organic products, while still relatively expensive, has been rising 20% a year since 1990 in the United States.(35) Entrepreneurs have incentives to provide the best nutritional products to the greatest number of consumers.

When government gets involved, the satisfaction derived by individuals from their activities (including nutrition) and the differences between individuals in terms of risk-taking and instant gratification(36) are disregarded. The Hercberg report (p. 88) laments the partial failure of the voluntary system for reducing salt in bread but fails to mention that the market responds to consumers’ wishes.

When government gets involved, political decisions become based on pressure group dynamics.(37) Lobbying exists to deter, legitimately, the implementation of taxes and regulations(38) and also to encourage legislation that benefits certain groups. It is symptomatic that revenues from nutrition taxes are used only rarely to fight health problems. They often go into general revenues.(39)

When government gets involved, relevant information is impoverished:

• Using the notion of body mass index is controversial. This is a statistical ratio that fails to distinguish between muscle mass and fat. Despite this, BMI forms the cornerstone of anti-obesity policies.(40)

• Moreover, the presumption by experts on the effects of the substances at issue and the policies they wish to institute is perplexing. We have stepped back from the “everything fat-free” outlook of the 1980s. In fact, it is not even certain that saturated fatty acids have the much demonised negative effects attributed to them. A growing number of studies reject the link between these fats and cardiovascular disease.(41) They show that obesity may be above all the symptom of endocrine pathologies rather than the result of caloric imbalance alone.(42)

• Also, although much denigrated, palm oil has worthwhile nutritional properties and offers significant economic advantages.(43)

This raises the matter of the legitimacy of government paternalism, especially with tax rates of more than 20% being considered.(44) Nutrition taxes are a rudimentary tool that makes no distinction between individuals who consume saturated fats in moderate quantities (and who should not be subject to taxation) and those who abuse them. Moreover, instituting tax levies has high economic costs and nurtures government interventionism. The experience of Denmark’s “fat tax” shows that lawmakers cannot disregard the costs stemming from the existence of taxes. The Daubigny-Deroche and Hercberg reports both highlight the supposed advantages of nutrition taxes(45) but underestimate the costs of a complex system of taxes and subsidies.

CONCLUSION

The impact of taxes in reducing the consumption of nutritionally poor foods is uncertain. While the goals may be laudable (though this is questionable), there is a major risk of applying additional constraints on economic activity without getting the expected public health benefits (in particular, improved results from France’s National Nutrition and Health Program) while nurturing a dynamic of government interventionism that is making French society more sclerotic.

Experts and public authorities tend to depict a black-and-white situation, whereas reality is far more complex. Excess weight and the pathologies it leads to are a relatively recent problem in the history of humankind. We still lack the full knowledge that could guarantee an adequate solution. Although nutrition taxes may appear to provide a response, it is important to understand their limits, especially in terms of a rational approach to avoidance, because the economic costs of these taxes are high in the long run.

We should not delude ourselves. In this time of strained public finances, an ulterior motive in the renewed interest in this type of levy is to generate more tax receipts. There are many precedents. President Franklin D. Roosevelt ended the prohibition of alcohol in the United States to boost tax revenues. Due to the Great Depression, Congress had an urgent need for financing, and the best way to get it was to institute taxes on alcohol.(46)

It is always preferable to change the context in which individuals make decisions so that they internalise the externalities they create. In this regard, obesity imposes few or no externalities if individuals bear its costs. We must therefore make sure that incentives for reducing obesity are in place. Nutrition taxes, by imposing the theoretical framework of caloric imbalance, would limit the emergence of new ideas that could help reduce excess weight. In the end, we need to show a degree of humility toward the social and biological process. Western society, open and based on free enterprise, dates back only to the late 18th century. It is possible that the human body, after many thousands of years of survival in penury, has not yet adjusted to the abundance generated by capitalism.

Notes

1. Enquête ObEpi-Roche, 2012. It should be noted that the rise in obesity has slowed since 2009.

2. Daudigny, Yves, and Deroche, Catherine, Rapport d’information sur la fiscalité comportementale, French Senate, No. 399, February 26, 2014

3. Hercberg, Serge, Propositions pour un nouvel élan de la politique nutritionnelle française de santé publique, La documentation française, November 15, 2013.

4. Hercberg, op. cit., 2013, p. 64, suggests taxes set according to the nutritional quality of food. The official aim is not to raise revenue (the VAT exists for that) but to encourage individuals to alter their dietary habits.

5. Hercberg, op. cit., 2013, p. 77.

6. Excise duties are amounts collected on quantities of certain items (e.g., quantities of alcohol or fat), while ad valorem taxes are collected on value (as with the VAT).

7. Gifford Jr., Adam, “Whiskey, Margarine, and Newspapers: a Tale of Three Taxes” in Shughart II, W. F. (dir.), Taxing Choice: the Predatory Politics of Fiscal Discrimination, Independent Institute, 1997.

8. There are five levies on alcohol (including a solidarity contribution), a premix tax, and taxes on sugary, sweetened and energy drinks respectively.

9. “Soft Drinks Tax Proposed”, Philippine Daily Inquirer, December 25, 2013.

10. “Singapore to Increase Sin Taxes”, Agence France-Presse, February 21, 2014.

11. Drenkard, Scott, Overreaching on Obesity: Governments Consider New Taxes on Soda and Candy, National Tax Foundation, 2011, p. 10.

12. See, for example, Viscusi, W. Kip, “The Governmental Composition of the Insurance Costs of Smoking,” Journal of Law and Economics, 1999. In contrast, the report by Yves Daubigny and Catherine Deroche, op. cit., p. 49 presents research claims that smoking-related externalities have a highly negative effect on the public accounts.

13. Van Ball, Pieter H. M., et al.. “Lifetime Medical Costs of Obesity: Prevention no Cure for Increasing Health Expenditure”, Plos Medicine, Volume 5 (2), 2008.

14. Over all, the costs of non-smokers of normal weight may be nearly 28% higher than those of smokers and 12% higher than those of obese people. See Petkancthin, Valentin, The Pitfalls of so-called “sin taxation”, Institut économique Molinari, January 2014.

15. Some insurance policies in the United States offer lower premiums for a body mass index below 25. See “Shrink Your BMI — and Your Insurance Bill”, NBC News, February 28, 2007. Airline companies provide another example. They do not take account of passengers’ weight in their fares, whereas total weight carried is a significant variable in airline economics.

16. Daubigny, Yves, and Deroche, Catherine, op. cit., p. 36.

17. Philipson, Tomas J., and Posner, Richard, “Long-Run Growth in Obesity as a Function of Technological Change”, Perspectives in Biology and Medicine, Volume 46 (3), 2003.

18. National accounts, household consumption des ménages, INSEE, p. 18, available at: http://www.insee.fr/fr/themes/theme.asp?theme=16&sous_theme=2.3

19. Cohen, Deborah, Five Myths About Obesity, Rand Corporation, 2013. In France, restaurant spending fell from 4.4% of consumption budgets in 1959 to 3.8% in 2013 (INSEE).

20. INSEE Première, No. 1208.

21. In the United States, the difference is 500 calories a day. See Cohen, Deborah, op. cit., 2013. It should be noted that increased smoking among women is partly a response to excess weight. Some argue that higher average weight is a result of less smoking since the 1980s. See Philipson, Tomas J., and Posner, Richard, op. cit., 2003.

22. “The Price of Age,” The Economist, December 21, 2000. See also Australian government statistics in Year Book Australia, 2001, available at:

http://www.abs.gov.au/Ausstats/abs@.nsf/Previousproducts/1301.0Feature Article482001?opendocument&tabname=Summary&prodno=1301.0&issue=2001&num=&view=

23. Hercberg, Serge, and Tallec, Anne, Le rapport du Haut Comité de la Santé Publique : “Pour une politique nutritionnelle de santé publique en France”, Ministry of Social Affairs and Health, Chapter 2, 2000.

24. Ayyagari, Padmaja, et al., “Sin Taxes: Do Heterogeneous Responses Undercut Their Value?”, NBER Working Paper 15124, 2009. This would also create a distortion in habits (and therefore a loss of well-being) and added administrative complexity.

25. Yaniv, Gideon, et al., “Junk Food, Home Cooking, Physical Activity and Obesity”, Journal of Public Economics, 2009. This would apply to individuals who pay attention to their weight when a tax raises the price of fast food and snacks.

26. A 20% tax rise would lead to a reduction in body mass index of just 0.05%. See Fletcher, Jason M., et al., “Can Soft Drink Taxes Reduce Population Weight?”, Contemporary Economic Policy, Volume 28 (1), 2010.

27. Some markets such as Estonia and Slovakia tried this. See “Up in Smoke”, The Economist, April 7, 2009. See Daubigny, Yves, and Deroche, Catherine, op. cit., p. 62.

28. Companies can also alter the characteristics of their products to minimise the impact of taxation. See Daubigny, Yves, and Deroche, Catherine, op. cit., p. 62.

29. “A Fat Chance”, The Economist, November 17, 2012. See also Petkantchin, Valentin, ‘Nutrition’ Taxes: the Costs of Denmark’s fat tax, Institut économique Molinari, 2013.

30. Lovenheim, Michael F. “How Far to the Border?: The Extent and Impact of Cross-Border Casual Cigarette Smuggling”, National Tax Journal, Volume 61 (1), 2008.

31. “Legal Vodka Production Falls by One-Third in Russia”, Russia Today, June 24, 2013. See also Petkanchin, Valentin, The Tax and Regulatory Causes of the Underground Economy, Institut économique Molinari, 2013.

32. Chen Zhen, Eric, et al., “Predicting the Effects of Sugar-Sweetened Beverage Taxes on Food and Beverage Demand in a Large Demand System”, American Journal of Agricultural Economics, Volume 96 (1), 2013. See also Daubigny, Yves, and Deroche, Catherine, op. cit., pp. 63 and 160.

33. See Drenkard, op. cit., pp. 4-5.

34. The impact of these measures is still uncertain. See Elbel, Brian, et al., “Calorie Labelling and Food Choices”, Health Affairs, 2014. See also Dumanovsky, Tamara, et al., “Changes in Energy Content of Lunchtime Purchases from Fast Food Restaurants After Introduction of Calorie Labelling”, BMJ, 2011.

35. Winter, Carl K., Davis, Sarah F., “Organic Foods”, Journal of Food Science, Volume 71 (9), 2006.

36. Smokers have greater risk tolerance and are more apt to seek instant gratification than non-smokers. See for example Viscusi, W. Kip, “Promoting Smokers’ Welfare with Responsible Taxation”, National Tax Journal, Volume 47 (3), 1994.

37. Interventionism is based on the idea of a benevolent state that can identify market failures perfectly and that can also implement adequate solutions. However, neither of these assumptions holds true in the real world.

38. There are many examples. The failure of New York’s soda tax in 2010 was due to lobbying by pressure groups. The same thing is happening now in San Francisco, where coalitions are organising against a similar levy. See “San Francisco Business Coalition Slams Proposed Tax on Sugary Drinks”, Inquirer, April 18, 2014. The near absence of taxes on wine in France (only €3.66 per hectolitre) or the threat of Coca-Cola suspending a €17-million investment in 2011 illustrate this dynamic.

39. Hoffer, Adam, et al., “Sin Taxes and Sindustry: Revenue, Paternalism, and Political Interest”, The Independent Review, Volume 19 (1), 2014. It should be noted that proceeds from sin taxes were taken partly off budget in the 1990s in France and brought back on budget in the 2000s. In fact, the allocation of tax proceeds varies frequently (see Daubigny, Yves, and Deroche, Catherine, op. cit., pp. 28-34).

40. Drenkard, op. cit., p. 2.

41. Teicholz, Nina, The Big Fat Surprise: Why Butter, Meat and Cheese Belong in a Healthy Diet, Simon and Shuster, 2014. See also Taubes, Gary, Why We Get Fat, Anchor, 2011, and, by the same author, Good Calories, Bad Calories: Fats, Carbs, and the Controversial Science of Diet and Health, Anchor, 2008. In addition, see the article “Ending the War on Fat”, featured on the front cover of Time magazine in June 2014.

42. Hite, Adele H., et al., “In the Face of Contradictory Evidence: Report of the Dietary Guidelines for Americans Committee”, Nutrition, Volume 26, 2010. See also Kabat, Geoffrey, “We Are Nowhere Near Understanding the Causes of Obesity and How to Prevent It”, Forbes, June 9, 2014.

43. Shimizu, Hiroko, and Desrochers, Pierre, The Health, Environmental and Economic Benefits of Palm Oil, Institut économique Molinari, 2012.

44. Hercberg, 2013, op. cit., p. 71. This is the recommended minimum for obtaining effects on consumption.

45. Daubigny, Yves, and Deroche, Catherine, op. cit., p. 39. The authors insist there are indirect benefits, or dividends, in employment, efficiency and redistribution, while minimising the impact of behavioural adjustments by consumers and producers.

46. Boudreaux, Donald J., and Pritchard, A. C., “The Price of Prohibition”, Arizona Law Review, Volume 36 (1), 1994.