France, Belgium Repeat as Highest-Taxed in Europe

Media release

Brussels, 27 July 2017 – No tax relief came this year for workers and employers in Belgium, where the Tax Liberation Day for workers is again July 27th – the second latest date in the EU-28, with France (July 29th) also unchanged from last year.

Using a consistent methodology across all countries, the data reflect the tax realities experienced by real, working people. 2017’s Tax Liberation Days are as follows:

Key findings – Belgium

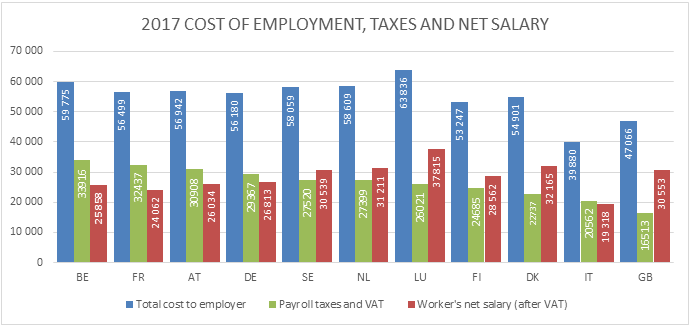

• Belgians are second-most expensive employees to hire in the EU, but rank 10th in net income.

• The Belgian government takes more than any other EU country from a typical employee’s salary (33 916€).

• Belgium is now the country that taxes labour at the second-highest rate in the European Union; an employer in Belgium spends 2.15€ for a typical worker to net 1€ after taxes.

• A Belgian employee’s “real tax rate” (including VAT) is now 56.7%, compared to an EU average of 44.8%.

Key findings – Europe

• As a single economic entity, workers across the European Union saw their average “real tax rate” fall again this year to 44.8%.

• Nearly half (44.4%) of payroll taxes collected in the EU – employer contributions to social security paid on top of gross salaries – are largely invisible to employees.

• In countries with “flat tax” policies, typical workers continue to be taxed at higher rates (45.5%) than in « progressive » systems (44.6%) – a gap that has widened since 2010.

• More than half (54.6%) of EU citizens are not in the workforce – a figure that grows as Europe’s population grows older.

Quote from co-author James Rogers:

“It was encouraging to hear Kris Peeters confirm that a ‘third wave’ of the ‘tax shift’ will lead to higher net pay for workers and lower costs for employers starting in 2018. For this year, there is no change: Belgians are still working five weeks longer than Swedes to pay their taxes. Nevertheless, they should be optimistic for next year.”

Quote from co-author Cécile Phillipe:

“Much still needs to be done in Belgium, but the current government has demonstrated its capacity to reverse the trend of the average Belgian employee. France is now last in our study. It is now its turn to show its capacity to reform when the cost/quality ratio of French public expenditures is poor in comparison with other countries that have a similar social tradition.”

“Tax Liberation Day” is the calendar day on which a worker theoretically stops working to pay taxes to the state and begins to keep his/her earnings. The data in the calendar reflect the reality experienced by real, working people in the European Union and the true cost of hiring employees in each state.

The study, by James Rogers and Cécile Philippe of Institut économique Molinari, uses OECD and national statistics office salary figures for as a baseline. Payroll tax calculations are made by EY.

The 2017 study is available from the following links:

French: https://www.institutmolinari.org/IMG/pdf/fardeau-fiscal-eu-2017.pdf

English: https://www.institutmolinari.org/IMG/pdf/tax-burden-eu-2017.pdf

Note to editors: The Institut économique Molinari (IEM) is an independent, non-profit research and educational organization. Its mission is to promote an economic approach to the study of public policy issues by offering innovative solutions that foster prosperity for all.

For more information please contact the authors of the study:

James Rogers

Research Fellow-Institut économique Molinari

james@institutmolinari.org

+ 32 497 946 840

Cécile Philippe

Director – Institut économique Molinari

cecile@institutmolinari.org

+33 678 869 858