Belgian workers’ taxes lower, but still among Europe’s highest

Brussels, 16 July 2020 – Belgian workers celebrate their “Tax Liberation Day” 23 days earlier than they did in 2013 and enjoy nearly 4 500€ more in annual net pay, according to the 11th edition of The Tax Burden of Typical Workers in the EU published today – though they remain the third-highest-taxed in the EU, after the French and Austrians.

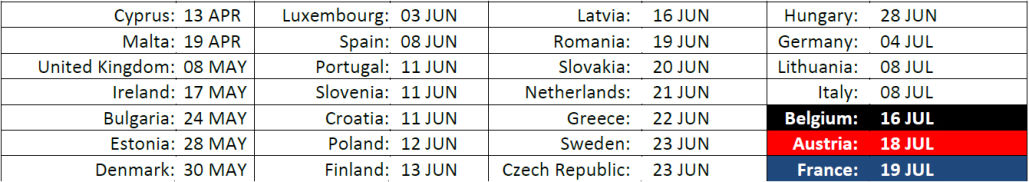

Using a consistent methodology across all countries, the data reflect the tax realities experienced by real, working people. 2020’s Tax Liberation Days are as follows:

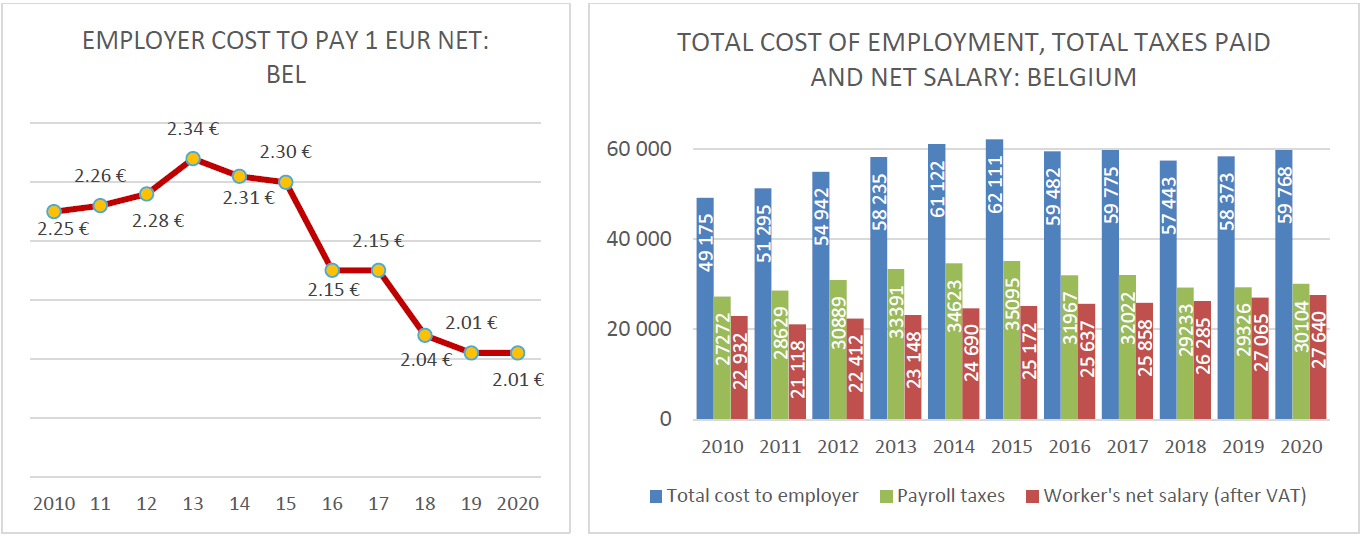

Belgium’s “tax shift” has significantly reduced the cost of hiring employees in Belgium, and the unemployment rate is now at its lowest rate since the inception of the study (2010).

Key findings – Belgium

- Until recently, Belgians were the most expensive to hire in the EU; in 2020 it costs employers less to hire in Belgium than in Germany, the Netherlands, Austria or Luxembourg – yet Belgians still rank 10th in take-home pay.

- An employer in Belgium spends 2.01€ for a typical worker to net 1€ after taxes – down from a peak of 2.34€ in 2013.

- A Belgian employee’s “real tax rate” (including VAT) is now 53.8%, compared to an EU-28 average of 44.7%

- The Belgian government collects 32,129€ from a typical Belgian worker’s wages (including estimated VAT) – the 2nd highest figure in Europe – yet it does not deliver services at this level. Among the 28 EU countries, Belgium ranks:

- 10th in reading, 9th in Science, and 6th in mathematics in the OECD’s 2018 PISA rankings of educational systems

- 10th in the 2019 United Nations’ World Happiness Report

- 11th (last place) in The Economist rankings of response to the coronavirus crisis

Quote from co-author James Rogers:

“The ‘tax shift’ is now complete and the results are positive: record-low unemployment, and purchasing power is on the rise. But still, Belgians are not getting good value from their government: Workers elsewhere in Europe are paying lower taxes while getting better health care, education and well-being in return.”

“Tax Liberation Day” is the calendar day on which a worker theoretically stops working to pay taxes to the state and begins to keep his/her earnings. The data in the calendar reflect the reality experienced by real, working people in the European Union and the true cost of hiring employees in each state.

The study, by James Rogers and Cécile Philippe of Institut économique Molinari, uses OECD and national statistics office salary figures for as a baseline. Payroll tax calculations are made by EY.

Note to editors: The Institut économique Molinari (IEM) is an independent, non-profit research and educational organization. Its mission is to promote an economic approach to the study of public policy issues by offering innovative solutions that foster prosperity for all.

Download the full study here:

https://www.institutmolinari.org/wp-content/uploads/2020/07/tax_burden_EU_2020.pdf

For more information please contact the authors of the study:

James Rogers

Research Fellow-Institut économique Molinari

james@institutmolinari.org

+ 32 497 946 840

Cécile Philippe

Director – Institut économique Molinari

cecile@institutmolinari.org

+33 678 869 858

Voir communiqué de presse en français

Zie persbericht in het Nederlands