Funding the pensions of civil servants could save up to €60 billion a year

Paris, January 16, 2025 – The Institut Economique Molinari is releasing an original study showing that the State could save €60 billion per year by expanding the Fonds de réserve pour les retraites (FRR) to finance the pensions of civil servants.

Based on official data as well as on the experience of provisioning pensions for public employees both in France (Banque de France, Senate) and abroad (Quebec), this ground-breaking study quantifies the gains for taxpayers and civil servants associated with such provisioning between now and 2070.

Up to €60 billion a year in savings by funding pensions

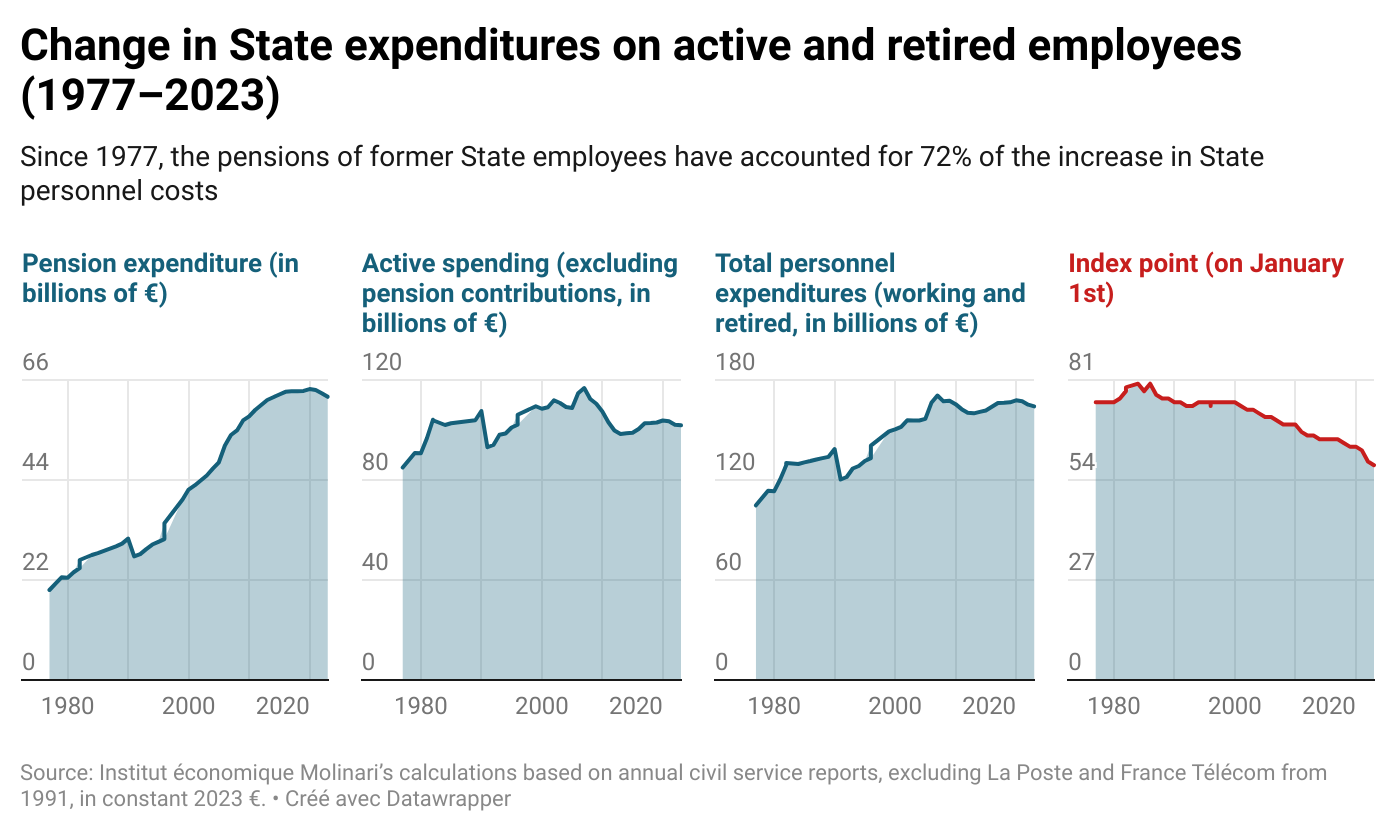

Since 1977, State civil service pension expenditures have tripled, representing €62 billion in 2023 compared with €20 billion in 1977 (in constant €).

If, like the Senate, the State had funded pensions partially, it would have saved €35 billion in 2023. If, like the Banque de France, it had made full provisions for the pensions of its employees, the State would have saved €60 billion.

Provisioning means investing capital that yields a good return, thereby reducing the cost of pensions paid to retirees without endangering the promised benefits.

Provisioning pays off, even when done through debt

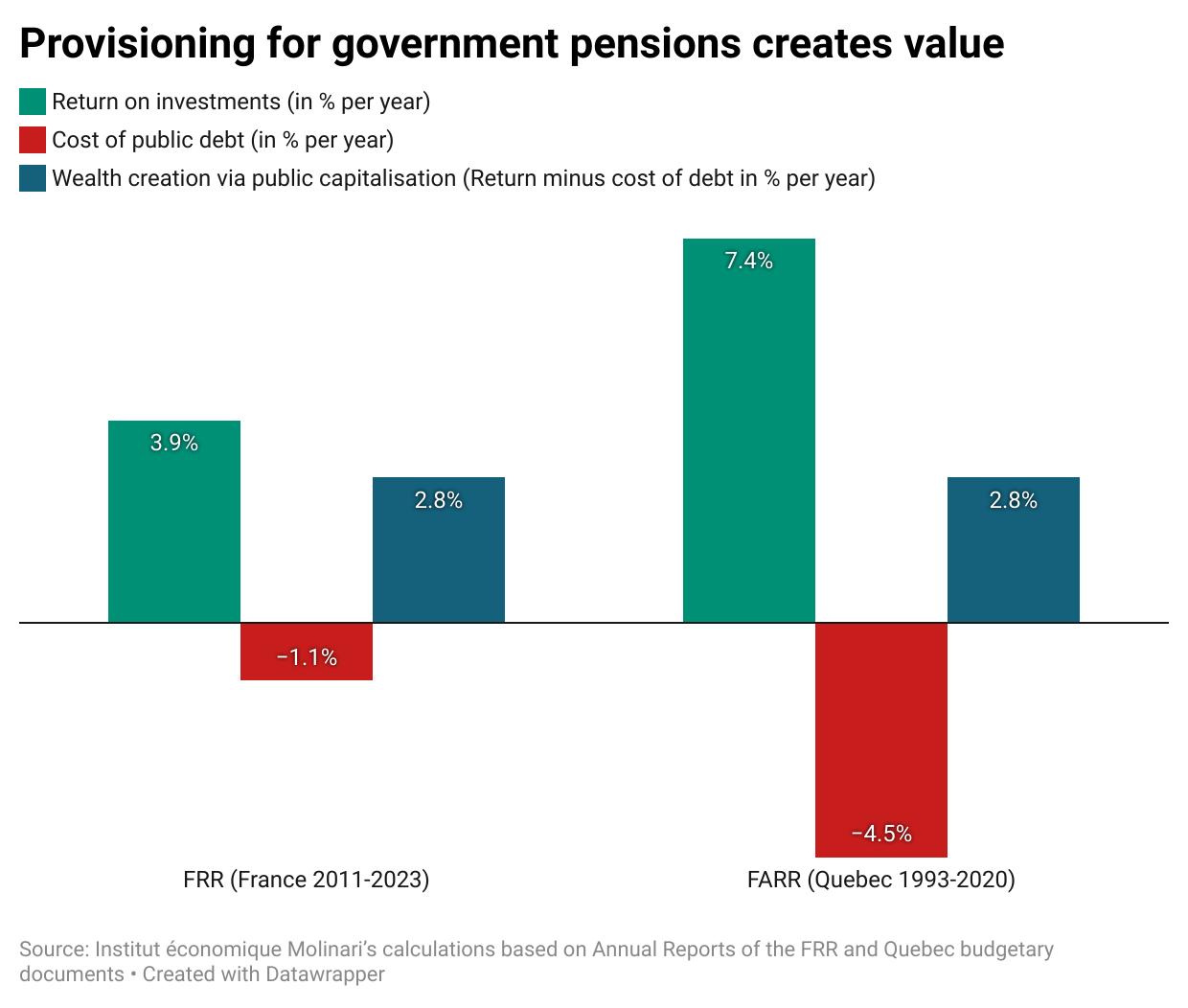

In France, the Fonds de réserve pour les retraites (FRR) has returned 2.8% a year since 2011. This takes into account the income and capital gains generated by medium-term savings (3.9% a year), with the cost of the French social security debt (1.1% a year) deducted.

This is not an isolated example. The Retirement Plans Sinking Fund (FARR), which provides for the pensions of Quebec government employees, has returned 2.8% a year since 1994, when the return on long-term savings (7.4% a year) is combined with the cost of the public debt (4.5% a year on average).

Resizing the Fonds de réserve pour les retraites to finance €60 billion in pensions a year

If the FRR had been funded as planned, it would have reached €150 billion by 2020. According to calculations by the Institut économique Molinari, it would have generated gains of €76 billion, instead of the €13 billion in wealth created since 2011.

If the FRR were entrusted with the provisioning of State civil service pensions by investing 1% of GDP per year by borrowing on the financial markets, the cumulative growth over 42 years would make it possible to create a sovereign fund representing 88% of GDP. After deducting the 40% debt and the interest charges, this operation would enrich the State to the tune of 48% of GDP.

By 2070, the interest generated by this sovereign wealth fund would be enough to finance all the pensions the State pays to its former employees, and to keep the size of the fund constant in order to finance the pensions of State employees indefinitely.

A challenge for civil servants, the victims of unfunded pension liabilities

Over the period of 1977–2023, pensions accounted for 71% of the surge in State personnel costs (€59 billion by 2023). Pensions rose by €42 billion (more than inflation by 2.5% a year), much faster than the remuneration of State employees (up €17 billion, or 0.4% a year above inflation). Over the same period, the civil service index point lost 0.6% a year after inflation.

These phenomena are connected. In the State budget, personnel expenditures serve also as a pension fund, used to pay both working people and pensioners. Increases in pension costs automatically reduce the resources available to pay working people better, whether this involves increasing the civil service index point, bonuses or staff numbers. For example, by 2023, the cost of pensions will account for 30% of the funds allocated to the French education system, which makes it difficult to make the teaching profession more attractive from a financial point of view, since any financial room for manoeuvre will be eaten up by pensions.

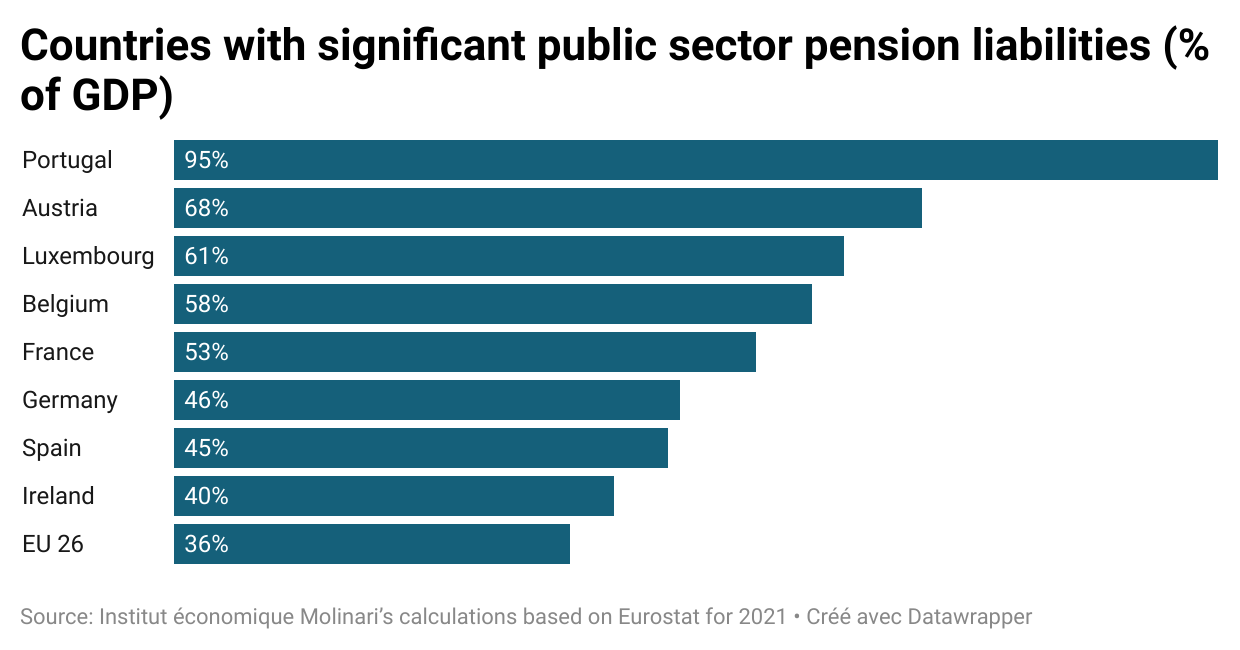

A European challenge worth €4,800 billion

In Europe in 2021, the promises made to public sector employees within specific pension schemes represented 36% of GDP, or €4,800 billion. It’s 45% of GDP in Germany and Spain, countries which are planning to build up sovereign wealth funds dedicated to pensions through debt.

A proposal based on three successes in provisioning by French or foreign administrations

The bold success of the collective capitalisation of the Banque de France: Its pensions are fully funded with €14 billion invested at the end of 2023, making it possible to reimburse €2.6 billion in over-funding of its pensions at the end of 2020, 2021 and 2023, all without costing the taxpayer a single euro.

The modest success of the Senate‘s collective savings schemes for its staff and elected representatives: With €1.7 billion invested by the end of 2023 and €657 million saved over the period 2008–2022, it represented 13% of the Senate’s operating expenses.

The success of the debt-based funding of Quebec government pensions: Quebec’s Retirement Plans Sinking Fund (FARR) will be able to make the first payments in 2024-2025. With a return of 7.4% between 1994 and 2023 and wealth creation of 2.8% per year once the cost of the debt has been deducted, this fund provides for all the promises made to public employees.

QUOTES

Nicolas Marques, Director General of the Institut économique Molinari (IEM), author

“France must provision the pensions of civil servants so that they no longer weigh on the budget, the taxpayer and the deficit. Our figures show that this represents a massive and untapped source of savings, amounting to €60 billion a year by 2070.

“The French State, which boasts an efficient sovereign wealth fund, the Fonds de réserve pour les retraites (FRR) created more than 20 years ago by Lionel Jospin, should put this issue on the agenda, as it will have a major impact on deficit reduction, the value for money of public services, and employee remuneration.”

Cécile Philippe, President of the Institut économique Molinari (IEM).

“Faced with an aging population, we have two paths available. One is to reduce benefits. The other is to add a significant amount of collective capitalisation to help finance pensions. If this approach is not adopted across the board, we will see the impoverishment of both working and retired people, and a reduction in the service provided to taxpayers.

“Collective capitalisation is an opportunity not only for purchasing power, but also for the development of our economies, because more long-term savings means more innovation and jobs. Without capital, there can be no wealth creation. It is no coincidence that Europe is lagging behind the rest of the world in terms of innovation and growth.”

STUDY

Link to the study Provisionner les retraites des fonctionnaires pour restaurer les finances publiques (34 pages, in French only) : https://www.institutmolinari.org/wp-content/uploads/2025/01/etude-provisionnement-fonctionnaires-2025.pdf

Link to Datawrapper 1 : https://www.datawrapper.de/_/NriT3/

Link to Datawrapper 2 : https://www.datawrapper.de/_/m9jZu/

Link to Datawrapper 3 : https://www.datawrapper.de/_/SanJe/

ABOUT THE INSTITUT ÉCONOMIQUE MOLINARI

The Institut économique Molinari (Paris and Brussels) is an independent research and education organisation. It seeks to stimulate the economic approach in the analysis of public policy, offering innovative alternative solutions that favour the prosperity of all individuals making up society.

FOR INFORMATION OR INTERVIEWS, PLEASE CONTACT THE AUTHORS

Nicolas Marques, General manager of the Institut économique Molinari (Paris, French),

nicolas@institutmolinari.org, +33 6 64 94 80 61

Cécile Philippe, President of the Institut économique Molinari (Paris, French or English), cecile@institutmolinari.org, +33 6 78 86 98 58