The wealth and earnings created by the CAC 40 companies benefit employees and governments more than shareholders

Media release

Paris, August 27, 2018 – The Institut économique Molinari has released a new study on the social and fiscal contribution of the CAC 40 companies. It presents a new way of quantifying the wealth created by these companies, outlining the sharing of this wealth between employees, governments and shareholders.

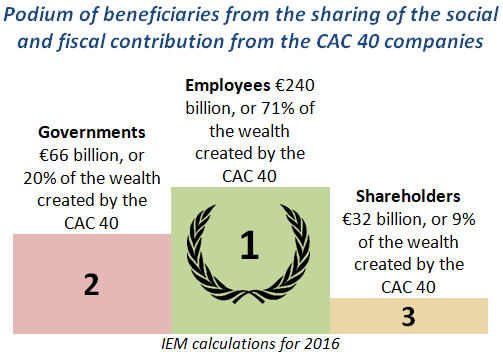

It shows that the CAC 40 companies created €338 billion in wealth for the French and global community in 2016. Employees are the greatest beneficiaries, with €240 billion in wealth, followed by French and foreign governments (€66 billion) and shareholders (€32 billion).

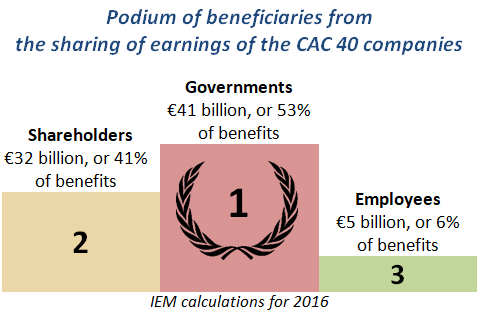

If we focus only on the share of earnings, governments appear to be the top beneficiaries with €41 billion, followed by non-government, non-employee shareholders (€32 billion) and then by employees (€5 billion).

EMPLOYEES ARE THE PRIMARY BENEFICIARIES OF THE SHARING OF WEALTH CREATION BY FRANCE’S CAC 40 COMPANIES

The study shows that the CAC 40 companies created €338 billion in wealth for the French and global community in 2016. This €338 billion was shared between employees (71%), the French and foreign governments (20%) and shareholders (9%).

Employees are the top beneficiaries of this wealth creation, with €235 billion in staff expenditures (wages, bonuses, compulsory and optional social protection, etc.), €4 billion in employee savings and share ownership and €1 billion in dividends.

Governments are the second greatest beneficiaries, with €25 billion in taxes on production and €28 billion in corporate income taxes plus €10 billion in taxes on dividends and €3 billion in dividends, with governments benefiting from dividend distributions through taxation and as shareholders.

Among them, the French government has a particular interest in this. On the one hand, it gets revenues from taxes on production and on profits. In addition, it benefits from the various taxes on dividends distributed to physical persons and corporate entities that own the rest of the capital. Also, it receives earnings from dividend distributions as a reference shareholder (it owns 3.5% of the capital in the CAC 40 companies).

Shareholders follow behind employees and governments. They are the third-ranking beneficiaries, with €32 billion in dividends (net of taxes and dividends paid to employees and governments). Far from grabbing most of the profits, they take part in a collective wealth creation chain accounting for €338 billion in France and abroad.

STATES ARE THE FIRST BENEFICIARIES OF THE SHARE OF EARNINGS

If we focus only on the share of earnings, governments appear to be the top beneficiaries, followed by non-government, non-employee shareholders and then by employees.

Government are the greatest beneficiaries of the sharing of earnings, with €28 billion in taxes on earnings, €10 billion in taxes on dividends and €3 billion in actual dividends, with governments benefiting from dividend distributions both through taxation and as shareholders.

Shareholders are the second greatest beneficiaries from the sharing of earnings, with €32 billion in dividends after deduction of taxes and dividends paid to employees and governments.

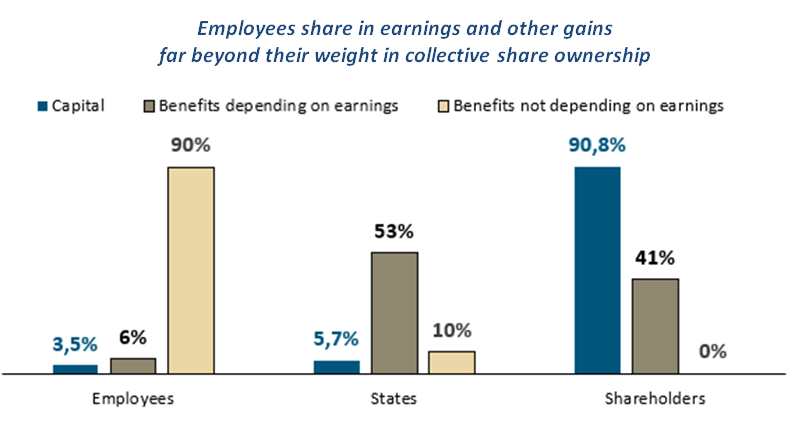

Employees are the third greatest beneficiaries from the sharing of earnings, with €5 billion (€4 billion in group savings and share ownership and €1 billion in net dividends). With 3.5% of the capital, they get 6% of the benefits from the CAC 40 companies’ earnings and 90% of gains independent of earnings.

AN ORIGINAL ECONOMIC APPROACH

This study provides original numbers on the sharing of the wealth created by the CAC 40 companies and on the sharing of earnings.

The social and fiscal contribution from large companies in France and worldwide remains largely unrecognised. Traditional accounting and financial presentations do not provide for externalisation of the creation of value for the broader community. Devised to present corporate earnings, they focus on financial data and understate the benefits for the French and global community while overstating shareholders’ income by presenting dividends before taxes.

This study aims to remedy this. It identifies and quantifies the gains for employees, governments and shareholders with a sound, robust and well documented. It aims at showing orders of magnitude allowing for a true debate on the creation and sharing of the wealth created by businesses.

QUOTES

Cécile Philippe, President of the Institut économique Molinari and co-author

“The IEM study shows that businesses play a part in a collective wealth creation chain that benefits employees first and foremost, with €240 billion in 2016, then governments with €66 billion and finally shareholders with €32 billion.

“Focusing on profits alone is not sufficient to grasp the scope of companies’ social and fiscal contribution. The bias that sometimes leads to shareholders being presented as enemies of employees has the flaw of obscuring an inescapable reality: employees, governments and shareholders all have an interest in the development of companies and in their earnings.”

Nicolas Marques, Director of the Institut économique Molinari and co-author

“These original numbers from the Institut économique Molinari show how the big companies benefit employees and governments above all and shareholders to a lesser extent.

“In 2016, they distributed seven times more wealth to employees than to shareholders and twice as much to governments as to the owners of capital. Even with a focus on profits alone, shareholders end up behind governments.

“These orders of magnitude should take the heat out of the debate on large companies and the sharing of their value creation.”

ABOUT IEM

The report is written by Cécile Philippe and Nicolas Marques of the Institut économique Molinari (IEM).

The Association Institut économique Molinari has as its purpose to create greater understanding of economic phenomena and challenges and to make them more accessible to the general public. Accordingly, it conducts scientific research, organizes think tanks, produces publications and provides training and varied forms of teaching toward this end to the broadest possible audience.

THE REPORT IS AVAILABLE IN:

• French at : https://www.institutmolinari.org/le-partage-de-la-contribution,3475.html

• English at : https://www.institutmolinari.org/the-social-and-fiscal-contribution,3474.html

FOR THOSE WHO WANT TO UNDERSTAND THE METHODLOGICAL DIFFERENCES

The IEM, aware that its numbers differ from other appraisals of magnitude, is also providing a methodology paper titled “Quelques biais à surmonter pour avoir un vrai débat sur l’entreprise” (Some biases to overcome for a true debate on business). This document identifies the pitfalls to be avoided so as to allow for a constructive debate on business. It is available here in French only.

FOR INFORMATION OR INTERVIEWS, CONTACT THE AUTHORS

• Cécile Philippe, President Institut économique Molinari (Paris, French or English), cecile@institutmolinari.org, +33 6 78 86 98 58

• Nicolas Marques, Director Institut économique Molinari (Paris, French), nicolas@institutmolinari.org, +33 6 64 94 80 61