Instead of taxing digital companies to finance telecoms, Europe should eliminate more than €1.5 billion in IFER and production taxes, allow mergers of providers ten times smaller than in the US and catch up with €10 trillion in long-term investment

Paris, April 13, 2023 – In a study published this morning, the Institut économique Molinari dissects the structural factors holding back wealth creation in the European telecommunications sector.

The study concludes that the focus should be on eliminating the taxes that penalise networks, adapting European competition law to allow mergers, and removing anti-stock market regulatory biases rather than seeking to impose changes in profit-sharing agreements with industry players not subject to these European constraints.

TAXATION: Eliminate the €1.5 billion in production taxes such as the flat-rate tax on network companies (IFER) which are imposed in addition to higher taxes on profits than those paid by other companies in France and Germany.

The telecom sector’s capacity for development is hampered by burdensome double taxation. Production taxes are twice as high as in other market sectors. These are added to corporate taxes which are also abnormally high at eight percentage points above other economic sectors in France and Germany.

In the European Union (EU), production taxes net of subsidies on telecommunications were €2.6 billion in 2020, representing 1% of telecoms revenues. This proportion is twice as high as in the general market economy where production taxes average 0.5% of revenues.

In France, these production taxes represented 3.1% of telecoms revenues, compared to an average of 1.4% of revenues in the market economy. The existence of the IFER (Imposition forfaitaire des entreprises en réseau) impairs the development of France’s telecom players.

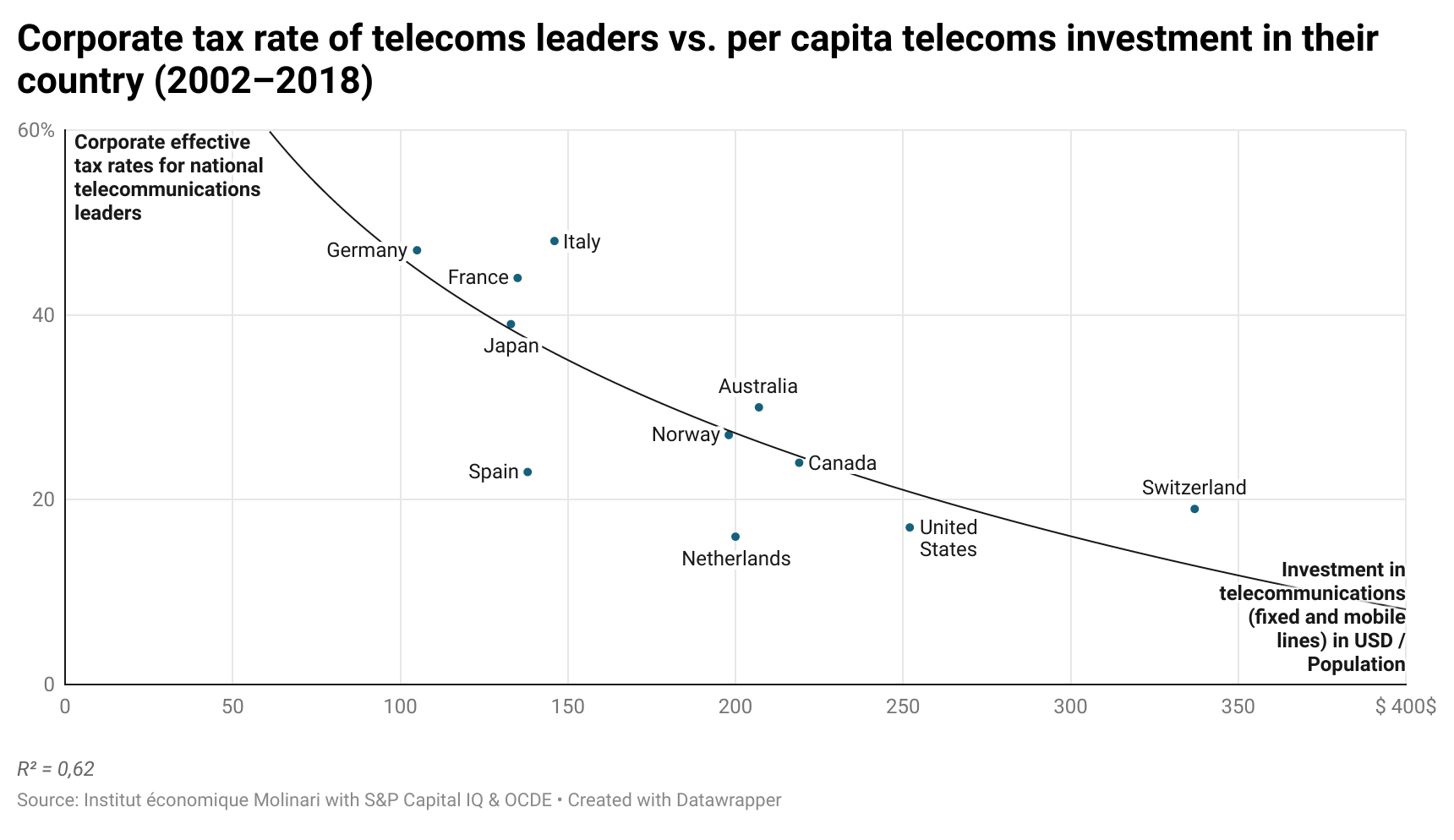

Compounding the problem is the fact that the tax burden on profits is also higher for telecoms companies in France and Germany. The average corporate tax rate levied on Orange S.A. was 39%, compared to 31% for large public companies in France over the last 20 years. In Germany, Deutsche Telekom’s average corporate tax rate was 37%, versus 28% for other large German companies. In these two countries, telecoms and network activities are at a major disadvantage with respect to firms that can deduct their intangible investments (R&D, etc.).

In contrast, the United States taxes its telecoms less than the average for large US companies.

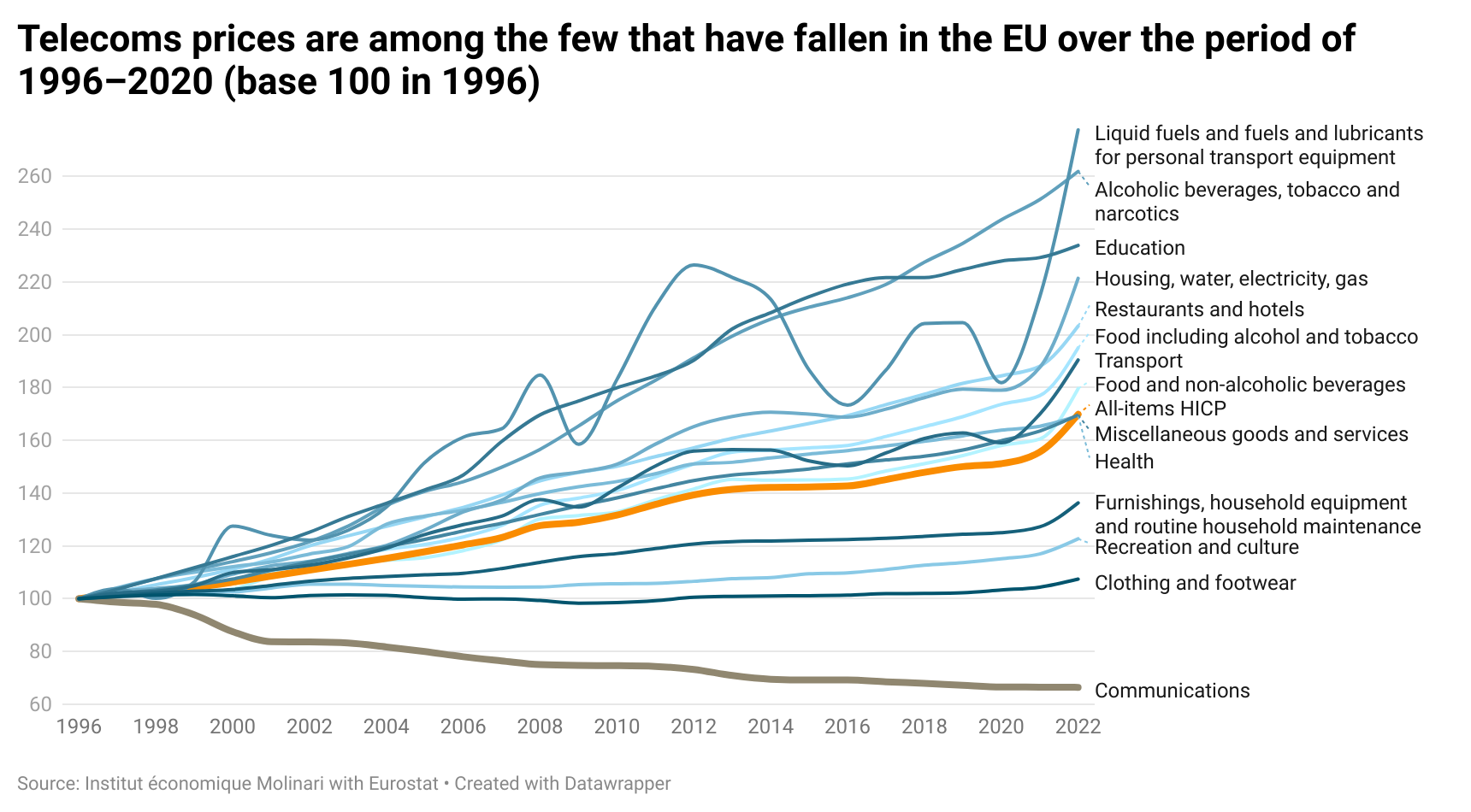

European telecoms players lack sufficient market power to pass on the additional costs of taxation to consumers. Consequently, this over-taxation hinders their capacity for investment in 5G or fibre optics.

COMPETITION LAW: Abandon the “magic number” of three to four operators per member state. It stifles innovation by maintaining players ten times smaller than in the United States.

The EU counts more than 40 mobile providers for 445 million inhabitants, with competition authorities pushing for each member state to maintain at least three or four.

By comparison, the United States has three main providers for a market of 332 million inhabitants. This translates to one provider for every 111 million customers, compared with one for every 11 million inhabitants in the EU.

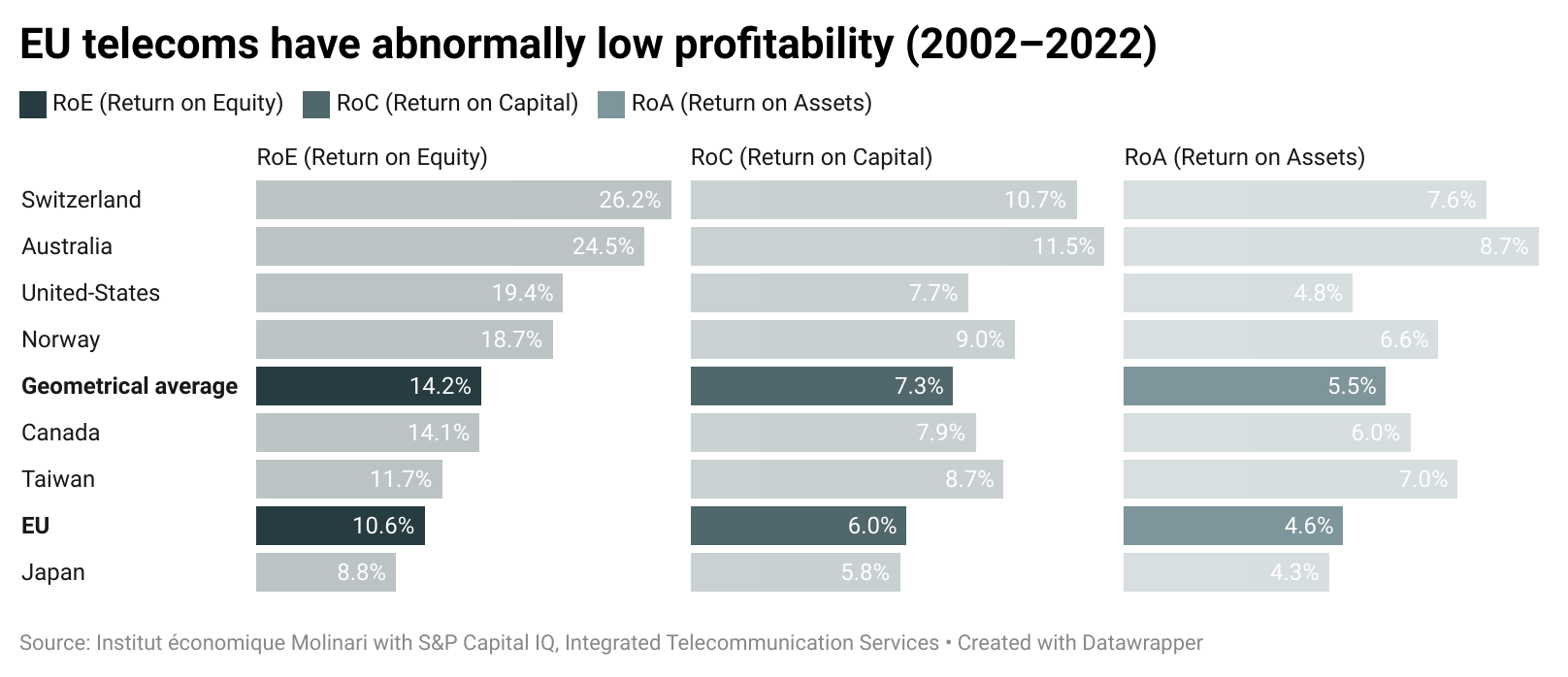

European providers’ return on equity (ROE) is well below that of most developed countries, averaging 10.6% per year over the period 2002–2022 in the EU, compared to 14.2% worldwide and 19.4% in the US.

Europe’s static approach to competition prevents consolidation of telecom players and perpetuates a rigid and fragmented market structure.

The authorities block companies from merging, which reduces development capacity and slows innovation. This will inevitably reduce the value for money of the services offered to households and businesses.

LONG-TERM SAVINGS: Make up for a long-term savings deficit of €10,000 billion.

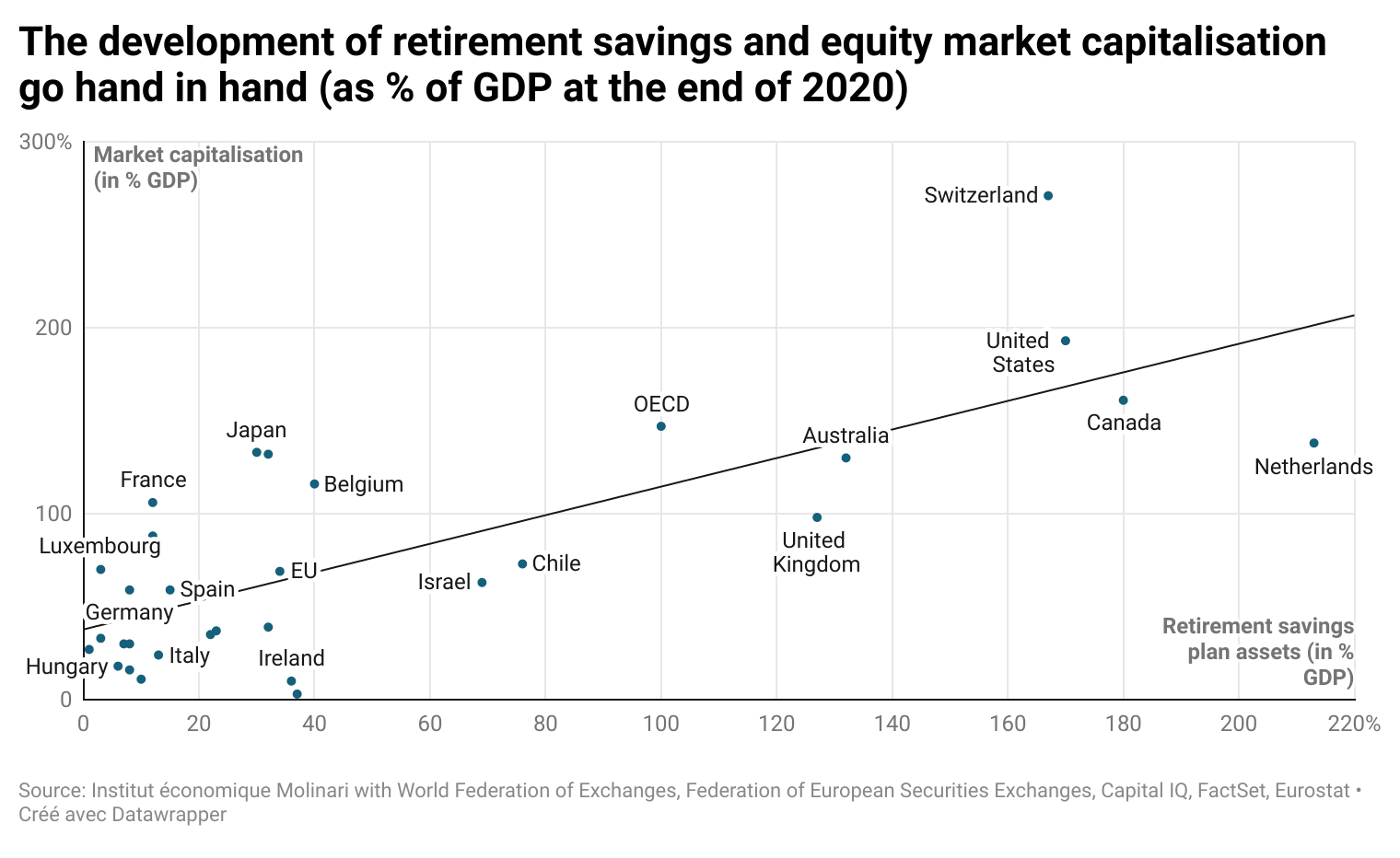

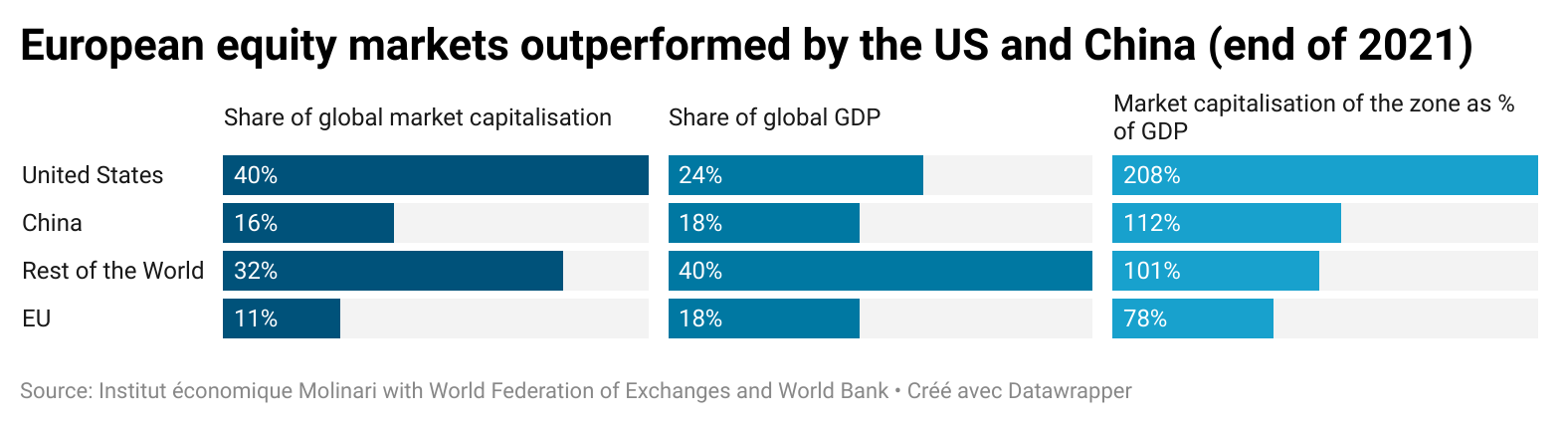

The EU has a market capitalisation deficit of €10.4 trillion when compared with the OECD. At the end of 2020, the market capitalisation of EU companies represented 70% of GDP, compared to an OECD average of 147%. France, with a market capitalisation of 106% of GDP, was somewhat behind the OECD average, while other European countries were even further behind. Notable among them is Germany, with market capitalisation representing only 59% of GDP.

This situation is largely due to the underdevelopment of pension funds and retirement savings.

Compared with the OECD average at the end of 2020, the EU had a shortfall of €8.9 trillion in long-term savings. At the end of 2021, pension funds represented 34% of GDP in Europe, compared with an OECD average of 100%. France, with pension funds at 12% of GDP, was far behind the OECD average, as was Germany at a mere 8%.

This shortfall represents a real handicap for the equity financing of European companies. The connection between the development of retirement savings and stock market capitalisation is significant. According to the OECD, pension funds allocate an average of 58% of their assets to their country of origin, and they are long-term investors.

The North American configuration—boasting a complete ecosystem for financing innovation from venture capital to the stock market which is largely fuelled by the capital of long-term investors such as pension funds—is absent in Europe.

This contributes to cumulative lags in areas of innovation and a rise in European dependency.

To make matters worse, European regulations are now working to artificially reduce the equity investment capacity of institutional investors such as insurers (Solvency II), governments (pushed to divest reserves to reduce debt and deficits) and even private individuals (with a MiFID II directive that fails to take into account the particular features of long-term savings).

The EU has been overtaken by the United States, but it is also losing ground to the rest of the world in the equity markets that are key to financing innovation.

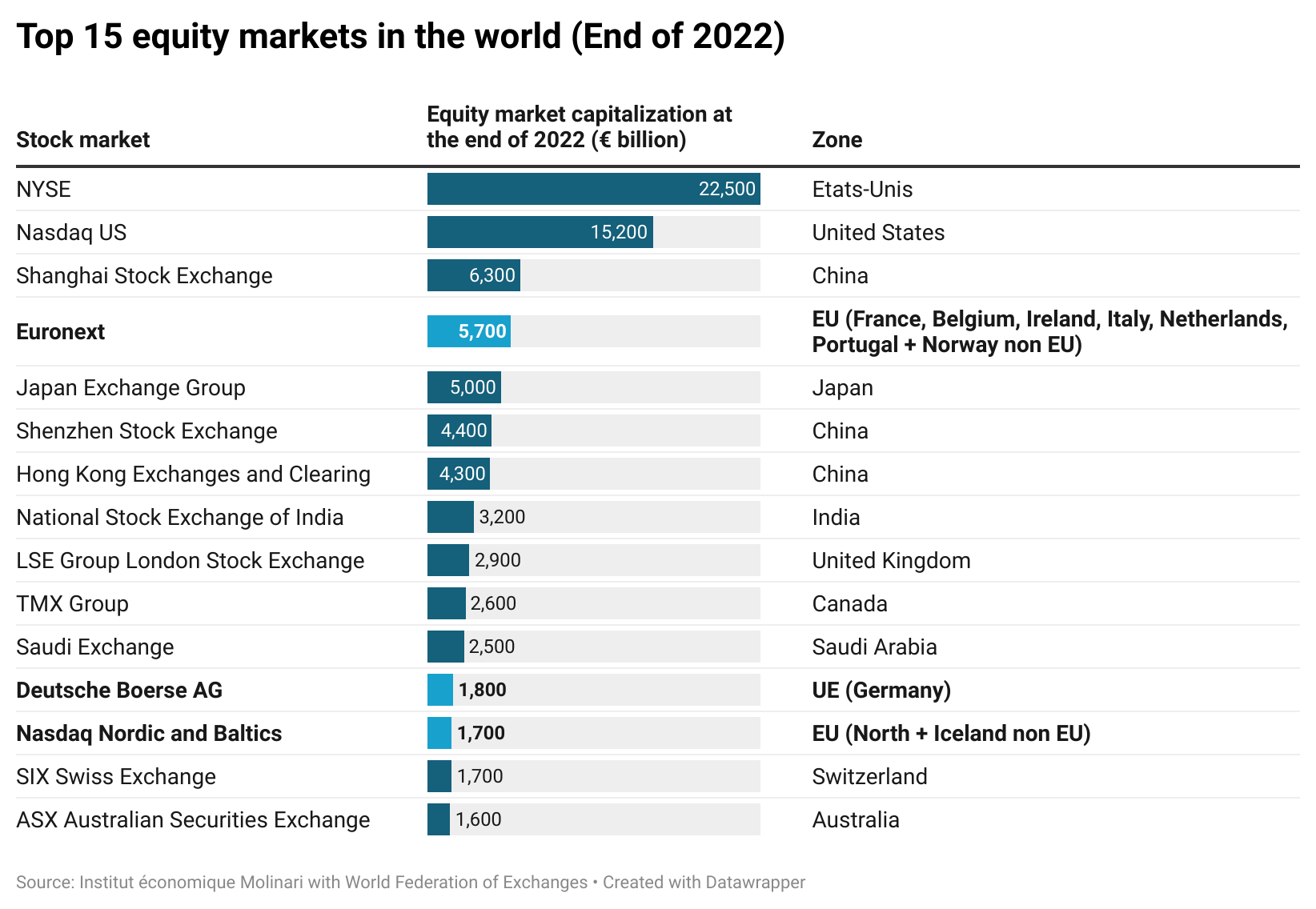

At the end of 2022, the total capitalisation of EU stock exchanges was €9.9 trillion, roughly one quarter the size of the American stock exchanges (€37.7 trillion for the NYSE plus Nasdaq). The largest EU stock exchange, Euronext, was one quarter as big as the NYSE (traditional US stocks) and one third as big as the Nasdaq (technology stocks).

If we want to redress these imbalances and prevent Europe’s inability to fund innovation from turning it into a “digital colony” of the United States and China in the long term, these financing issues should be considered high-priority.

RESOURCES

The study, “Telecoms and innovation, prioritising wealth creation rather than redistribution” (60 pages) was authored by Nicolas Marques and Aurélien Portuese.

It is available in French at the following link:

https://www.institutmolinari.org/wp-content/uploads/2023/04/etude-telecoms-et-innovation-2023.pdf

6 Datawrapper infographics are available:

- https://www.datawrapper.de/_/dst77/

- https://www.datawrapper.de/_/0iNnr/

- https://www.datawrapper.de/_/VZBVt/

- https://www.datawrapper.de/_/soweL/

- https://www.datawrapper.de/_/mT9X4/

- https://www.datawrapper.de/_/bS02z/

QUOTES

Cécile Philippe, President of l’Institut économique Molinari:

“Putting redistribution before wealth creation is an admission of helplessness and resignation. To believe that digital players themselves are responsible for the difficulties of European telecoms is a dead end. This market is dominated by national tax systems and European regulations that obstruct the industry’s ability to grow and evolve. The goal should be to relax the constraints on the telecommunications sector.”

Nicolas Marques, co-author of the study and Director General of l’Institut économique Molinari:

“Like many key activities in Europe, the telecoms are penalised by taxes and regulations that are both disproportionate and inappropriate. Instead of dreaming about taxing the foreign players who are more dynamic than we are, the priority should be on removing the obstacles to wealth creation. Lowering taxation in the sector, simplifying mergers, and encouraging long-term savings and investment are all essential if Europe is to avoid falling behind. This is crucial in telecommunications, as in all strategic sectors. Without suitable tax and regulatory frameworks and without long-term savings, we will fail to meet major challenges, whether in digitalisation, health care, or the energy transition.”

ABOUT THE THINK TANK

The Institut économique Molinari (IEM) is a research and education organization whose mission is to promote a better understanding of economic phenomena and challenges, by making them accessible to the general public. To this end, it carries out scientific research, organizes reflection circles, edits publications, offers training and all forms of teaching in this direction.

The IEM is a non-profit organization, funded by voluntary contributions from its members, individuals, foundations or companies. Asserting its intellectual independence, it did not accept any public subsidy.

FOR INFORMATION OR INTERVIEWS, CONTACT

Cécile Philippe, President, Institut économique Molinari

cecile@institutmolinari.org

+33 6 78 86 98 58

Or Nicolas Marques, Managing Director, Institut économique Molinari

nicolas@institutmolinari.org

+33 6 64 94 80 61