If the State had a pension fund as the Senate, it would have saved €433 billion over 15 years and reduced its deficit by 30%. The Senate is saving 13% on its expenditures through its pension fund

Paris, June 16, 2023 – The Institut économique Molinari has published an original study quantifying the savings realised by the Senate between 2008 and 2022 thanks to the capital-funded pension programs organised for its employees and elected representatives.

Compiled using the accounts of both assemblies and the State, this new study demonstrates that pension funds are a major source of savings.

€433 billion in savings for the State using the Senate model and a 30% reduction in the deficit over the last 15 years

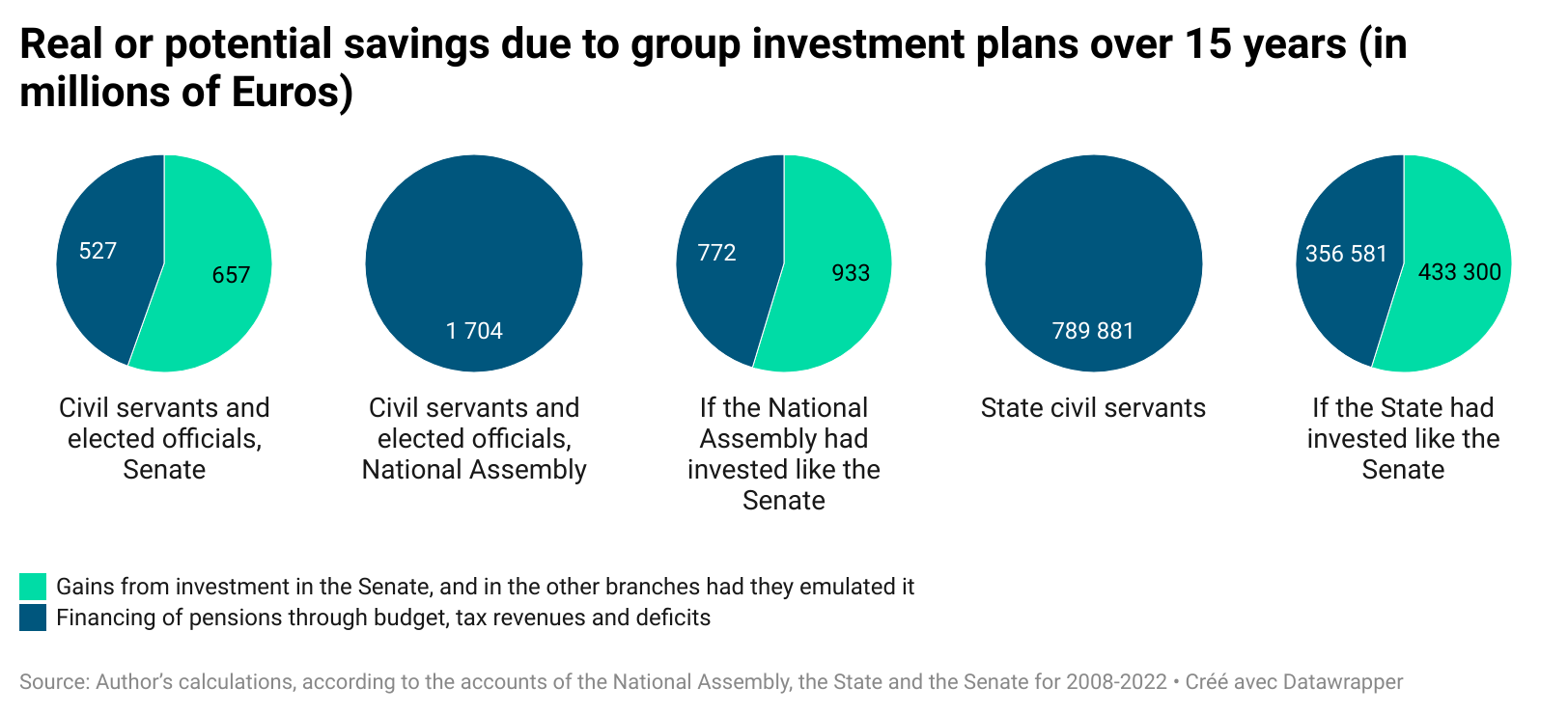

If the State had funded its pensions like the Senate does, it would have invested €920 billion in a sovereign wealth fund to finance the pensions of its employees, and saved 8% of its net costs over the last 15 years.

Through investments, the State would have self-financed 55% of the pensions it paid out, saving €433 billion out of expenditures of €789 billion between 2008 and 2022.

Over 15 years, the State would only have required €356 billion to come out of its budget to provide the balance.

The State would have saved an average of €29 billion every year, lowering its annual deficit by 30% from €95 billion to €66 billion.

€657 million in savings or 13% of its expenditures over 15 years thanks to the Senate’s pension funds

The Senate invested €1.6 billion in the financial markets in order to save the taxpayer from having to shoulder the entire burden of pension payments to its former staff and elected representatives. By the end of 2022, €870 million had been invested on behalf of former staff and €770 million on behalf of former senators.

This capital has yielded an average annual return of 4.1% over 15 years, income that allows the majority of the Senate’s pensions to be funded without reliance on taxpayers.

Between 2008 and 2022, pension fund investments saved the Senate €657 million in public money, or 13% of its operating expenses. The gains generated by the Senate’s holdings have contributed €359 million to the pensions of former staff and €298 million to those of former senators.

These gains from investment represent 55% of the total €1.2 billion in pensions paid out over the period. The remaining 45% (or €527 million) was financed by the Senate budget, ultimately coming either from taxpayers, or from adding to the public deficit.

If the Senate had financed its pensions on a day-to-day basis between 2008 and 2022—like the National Assembly and the State do—it would have required 11% more in State allocations to cover all the costs associated with paying pensions. Pensions would thus have accounted for 20% of the Senate’s current expenditures over the period instead of 10%.

If modelled on the Senate, the National Assembly would have realised savings of €933 million over the last 15 years, an 11% reduction in operating costs

If the National Assembly had funded its pensions the way the Senate does, it would have invested €2 billion to finance the pensions of both its staff and elected representatives, saving 11% of its operating costs over the last 15 years.

The Assembly would have used financial markets to self-finance 55% of the pensions it paid out, representing savings of €933 million on expenditures of €1.7 billion between 2008 and 2022.

The Assembly would have needed only 772 million from its budget to finance the balance.

It could have functioned with an operating budget that was 11% lower, one in which pensions accounted for only 10% of expenditures, rather than the 19% seen over the last 15 years.

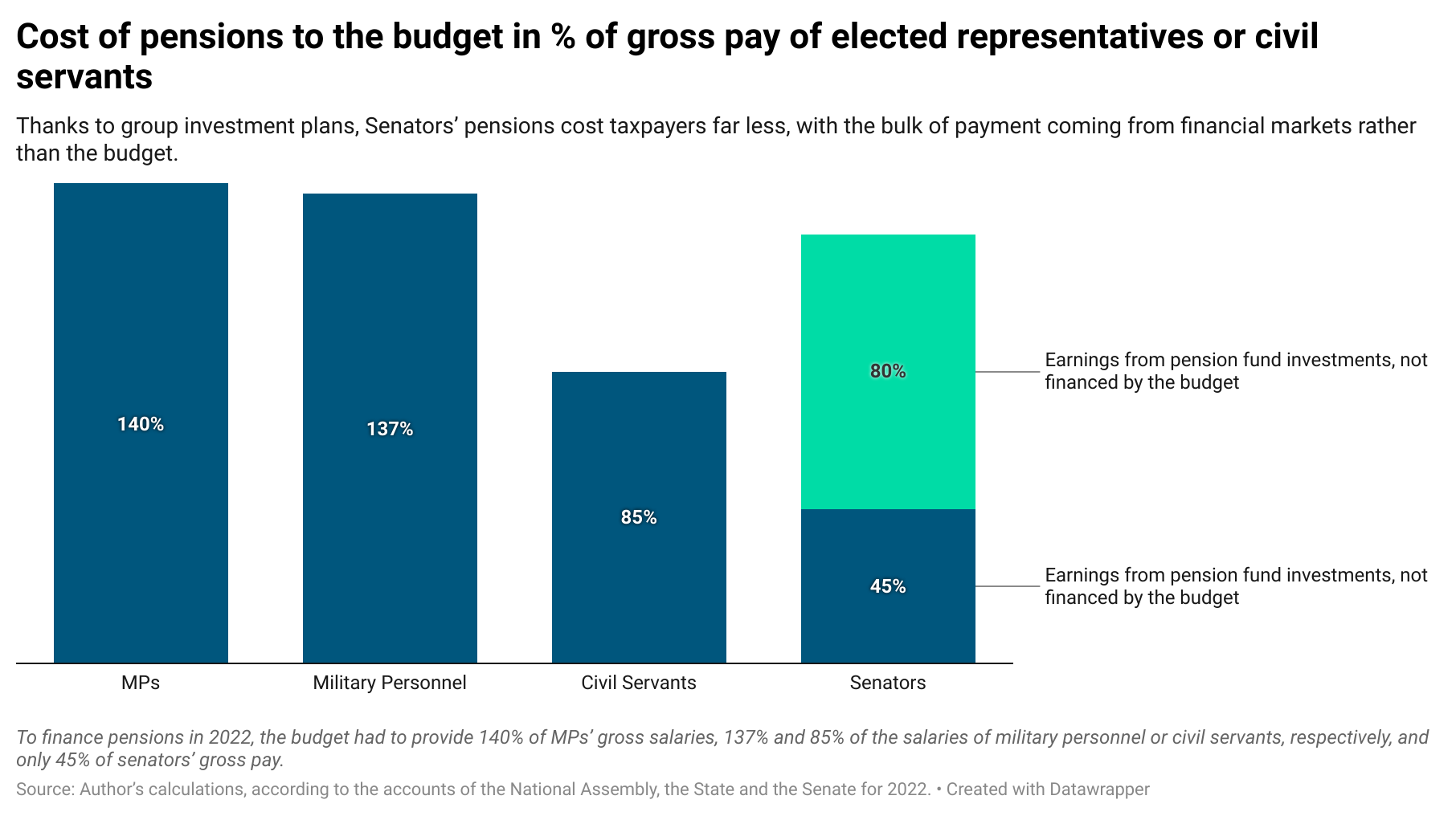

Pensions for senators cost one third as much as for members of parliament or the military, and one half as much as for civil servants

All the other administrations would benefit by imitating the Senate’s pension fund rather than ridiculing it. This would allow them to reduce their operating costs without cutting back on salaries, pensions, or the quality of public services.

The Senate’s pensions are 55% funded and thus cost the budget—and ultimately the taxpayers—much less than those of the National Assembly or the State.

The pension fund for employees and senators balances its accounts with payments financed out of the budget of the upper chamber (contributions from beneficiaries and payments from the Senate). These represent only 45% of the allowances paid to former employees and elected representatives.

Senators’ pensions consume only half as much public money as those of civil servants, who cost 85% of their salaries, compared with just 45% for senators.

The cost to the taxpayer of Senators’ pensions is just one third that of MPs (which cost 140% of their salary) or of military personnel (which cost 137% of their salary), both groups that tend to have short careers.

QUOTES

Nicolas Marques, study author and Director General of l’Institut économique Molinari.

“If the State had funded part of the pensions of its civil servants the same way the Senate did, it would have saved €433 billion over the last 15 years.

“Funding the civil service pensions [through pension funds] allows government spending to be reduced without cutting back on public services or the attractiveness of civil service jobs. This is France’s main avenue to cost savings. The government has promised €1,600 billion in pensions to current and retired civil servants outside the pay-as-you-go system. Since it has set aside nothing with which to honour this promise, major additional costs are generated for the budget, for taxpayers and for future generations.

“Unless you think that the State is going to call into question the status of public service, or bump civil servants to the pay-as-you-go system, it is essential to make provisions for funding civil service pensions. This is what the Senate and the Banque de France do, and with substantial savings for the taxpayer. The State should entrust this task to the Fonds de réserve pour les retraites, its under-used and under-developed sovereign wealth fund. Even when financed by debt, pension funds are a source of sustainable savings. This investment is essential if we are to reduce deficits significantly without undermining our obligations to civil servants.”

Cécile Philippe, President of l’Institut économique Molinari.

“Proper funding of civil service pensions is a responsible approach towards both taxpayers and public servants.

“Half a century after the end of the baby boom and the advent of systematic public deficits, the State must begin to act strategically and stop behaving as if public money were simply inexhaustible.

“If the French State were to follow the example of the Senate by using pension funds to fund part of the pensions of civil servants, it could reduce its deficit by 30% a year. This is the main vector for savings in the French public sector. Above all, it is the only way to reduce government spending over the long term without cutting public services or staff salaries.

“Until the State makes sustainable provisions for funding civil service pensions, it will be unable to reduce deficits significantly, unable to restore its financial credibility, and unable to attract people to the civil service. The collective pension fund approach should generate consensus between those committed to financial responsibility and those with the interests of civil servants at heart.”

STUDY

Link to study (33 pages, in French):

https://www.institutmolinari.org/wp-content/uploads/2023/06/etude-provisionnement-retraites-senat-2023.pdf

Link to Graphic 1: https://www.datawrapper.de/_/gWhd1/

Link to Graphic 2: https://www.datawrapper.de/_/1ngzr/

ABOUT THE STUDY

All calculations were based on official data, specifically the accounts of the Senate, the National Assembly, and the General account of the State, from 2008 to 2022.

ABOUT THE IEM

The Institut économique Molinari is a research and educational organisation whose mission is to promote better understanding of phenomena and challenges in economics by making them accessible to the general public. To this end, it conducts scientific research, organises think tanks, issues publications, and offers training and other forms of education. The IEM’s work helps to stimulate the emergence of new consensus by presenting economic analysis of public policy that illustrates the benefits of well-thought-out regulations and tax systems. The IEM is a not-for-profit organisation funded by voluntary contributions from its members, who may be individuals, foundations, or companies.

FOR INFORMATION OR INTERVIEWS, PLEASE CONTACT

- Nicolas Marques, study author and Director General of l’Institut économique Molinari

nicolas@institutmolinari.org, +33 6 64 94 80 61 - Cécile Philippe, President of l’Institut économique Molinari

cecile@institutmolinari.org, +33 6 78 86 98 58